A Click into the Future – Digital Legacy Fundraising

Donating your estate: Automated yet personal

Traditionally, the topic of “donating your estate” is preferably dealt with offline or sporadically via e-mail newsletters. But there is more to it! Marketing automation can be a great support by optimizing processes or even partially replacing offline estate donation acquisition with digital products. The baby boomer generation is approaching their retirement years and will be more concerned with their own estate planning in the future. Their digital affinity is still underestimated. This is where nonprofits can (and should) position themselves as advisors and assist their donors with digital legacy planning.

Donating your estate with a click – isn’t that a little much to ask?

Building a personal relationship is and remains the be-all and end-all of estate donor care. Decisions of such scope and importance require a personal contact who is available to answer questions and provide advice. The automation of individual processes is therefore in no way intended to replace personal contact. Getting supporters to donate their own estate, and to do so online, is a major challenge. This requires a lot of trust work in advance. That’s why automating the process is more a matter of supplementing communication. Automated workflows can relieve the burden on estate staff. For example, by automating part of the communication. This gives probate advisors more time for personal 1-on-1 support or for planning informational appointments and inheritance events.

It’s all a matter of strategy

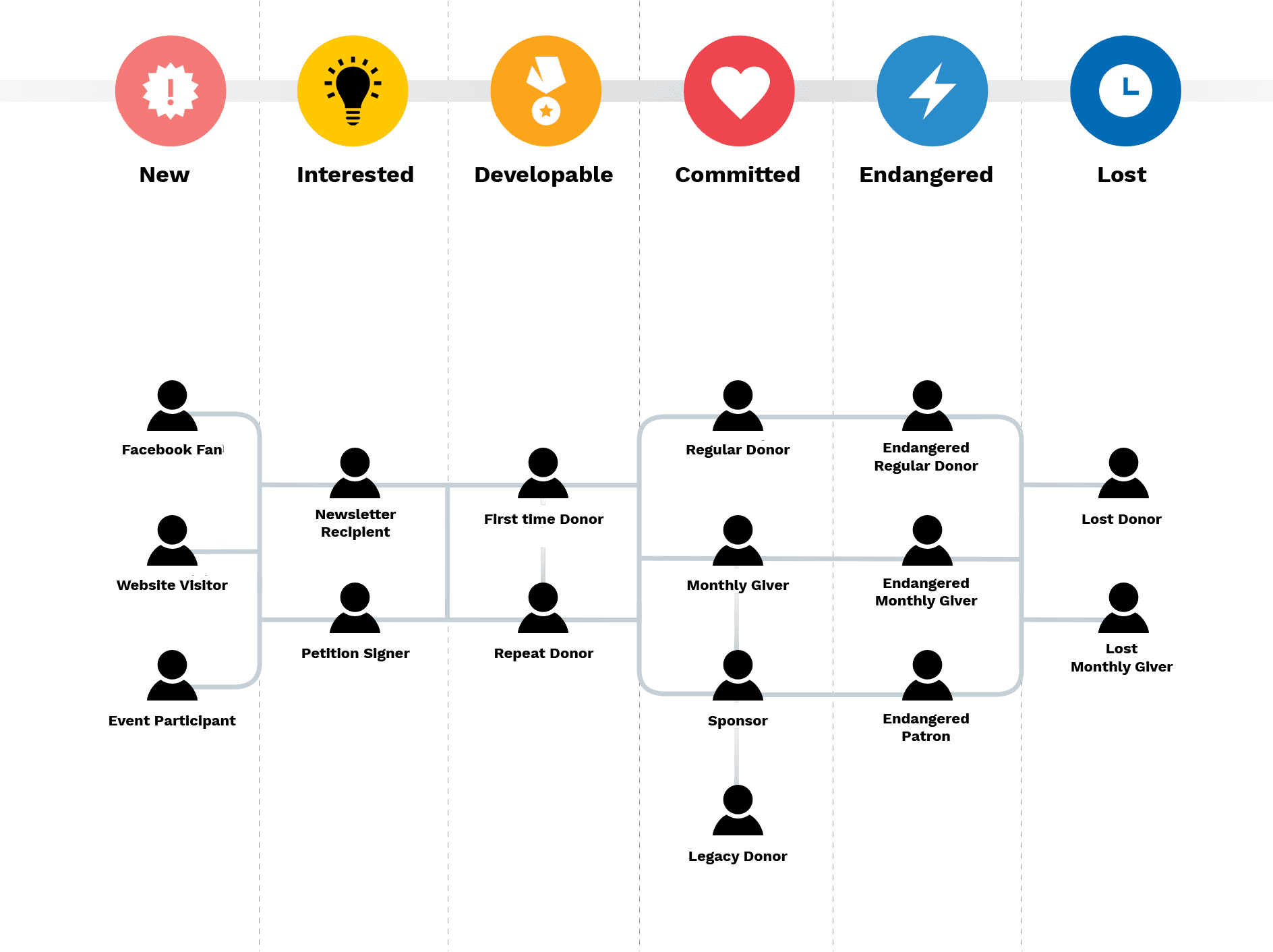

The subject of testaments requires a cautious approach, since one’s own passing is not exactly one of the favorites of personal time. That’s why you should avoid jumping in at the first opportunity. At best, you should reach your target group at the right time via the appropriate channel. To be able to guarantee this, it is advisable to approach the topic of wills within a larger strategy – the lifecycle strategy (LCS). Instead of just segmenting contacts by age, they can also be broken down by lifecycle phases (see image below). These phases are derived from the answer to the question of how strongly my contact is tied to my organization.

For example, a lead generated through a Facebook campaign may be interested in the work of your organization, but by no means is he or she firmly tied to the organization. In this case, it is important to think of measures to develop the contact into the next phase and to warm them up to the topic of testament donations. Permanent donors, on the other hand, can be approached somewhat more directly on the subject of “donating their estate”, as they are already familiar with the organization.

How to increase your chance of receiving a legacy endorsement

Now we know that the approach should be tailored to the engagement of the contact with your organization – but when is the right time to approach a person about donating their estate? To identify potential legacy donors, points can be awarded for each interaction with the organization using a testament scoring system. These interactions could be the following: Someone has shown interest in the topic, for example, by visiting numerous pages on estate and retirement planning, opening and clicking on all mails in the email automation, trying an inheritance calculator, or downloading a guidebook.

Such automated interest scoring helps focusing on the crucial leads. For example, only after a certain score is reached an advisor will contact them personally. Since the contact has already expressed great interest, the opportunity for a personal meeting should be used to further persuade them.

By the way, the notification of a high scoring level can also be automated. As soon as a contact exceeds a scoring threshold, the consultant receives a notification with relevant profile information and contact data.

GOOD TO KNOW!

It is important to bear in mind that, compared with the overall donation market, the legacy topic only appeals to a small target group. For this reason, the acquisition costs (e.g., cost per lead) are definitely higher than in broader individual giving. But in relation to what is gained in the end, the investment is worthwhile. After all, the amount involved in an inheritance is usually higher than a one-time donation. Digital legacy fundraising is currently still in its infancy and is new territory for many. This means for all fundraisers: Try, test and be flexible. A well considered concept and sensitive donor-centric communication with a strong value proposition are good prerequisites for success.

Creating sparks – digital communication for successful legacy giving

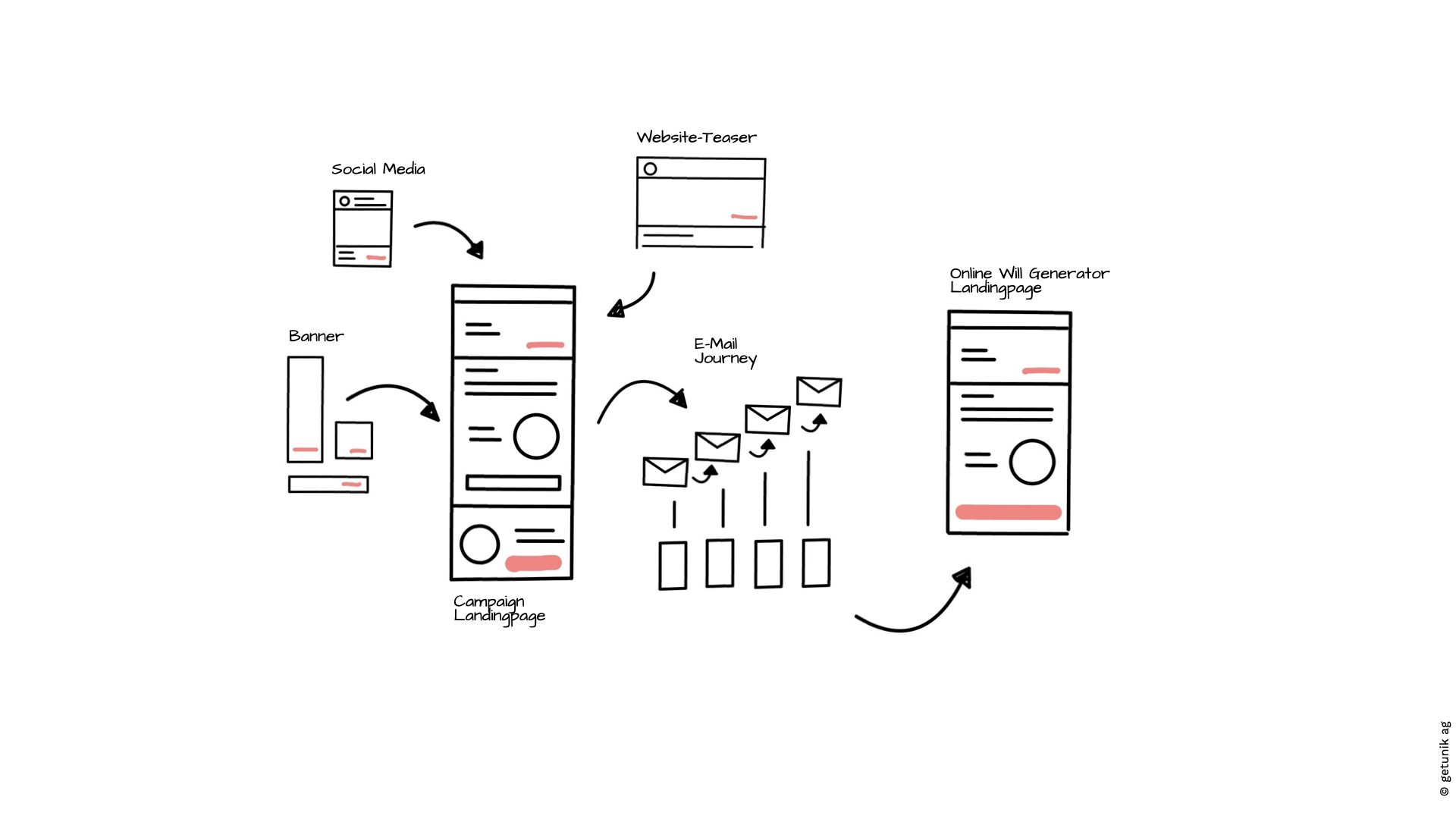

The framework is clear now, but what does automated communication look like? First, touchpoints are defined (social media, campaign landing page, e-mails, newsletters, etc.). These are derived from the target group analysis, which reveals where the target group is spending its time. Then the appropriate content is created for each touchpoint. The development of personas helps to address the target group. These are fictitious people who represent the target group. They have the same needs, motivations and goals as their real users and illustrate the user behavior of the individual target group members.

It is also essential that the entire journey across all touchpoints results in a consistent story, both in terms of text but also visually. Automation is designed to trigger further communication after each contact action and increase engagement with the contact. Smart and clearly placed call-to-actions in again increase the interaction between the organization and the contact.

Step 1 Create attention

At the awareness touchpoints, the first impression counts! This is where attention is generated regarding the legacy topic. An emotional video within a Facebook campaign, a thematic newsletter or a banner on the website – test what works best with your target group.

In doing so, you don’t have to call a spade a spade right away, either. Remember: Approach things slowly! Well aware that the topic of wills is a delicate one, the Swiss Red Cross, for example, approached probate with a Facebook campaign on the topic of retirement planning. The story hook consisted of various video formats. Sometimes they gave a glimpse of their lead magnet – the retirement planning folder – while other times the target group had their own say with their thoughts on the topic of retirement planning. A lead magnet is a free item or service that is given away for the purpose of collecting contact information. An incentive to give away contact information could be, for example, estate planning advice or a downloadable brochure, an invitation to an event, or a personal consultation. Again, try out what is most likely to appeal to the target audience.

Step 2 Generate interest

The lead magnet raises interest to look further into the topic. Therefore, the awareness part should lead directly to it. The important thing here is that it offers added value and fits the topic. Depending on where the contacts come from, the download link for the lead magnet can be placed differently. One option is to integrate it on a suitable campaign landing page. Another option is to download it via a Facebook Lead Ad. Facebook Lead Ads are ads in which the contact details are submitted directly in an integrated form, without redirecting to a landing page. In this case, the download can trigger an email journey, which in turn leads to the campaign landing page (see section “Step 3 Spark desire”). It is also important to offer added value on the landing page, for example by means of a short FAQ video with the most important questions about the topic of wills. In any case, the space should be used to communicate a strong value proposition: Why is it imperative to address estate planning and why now? What is the benefit of inheriting charitably? Why should people donate to your organization, of all organizations? Is the inheritance in good hands with you? At best, the landing page provides answers to all these questions.

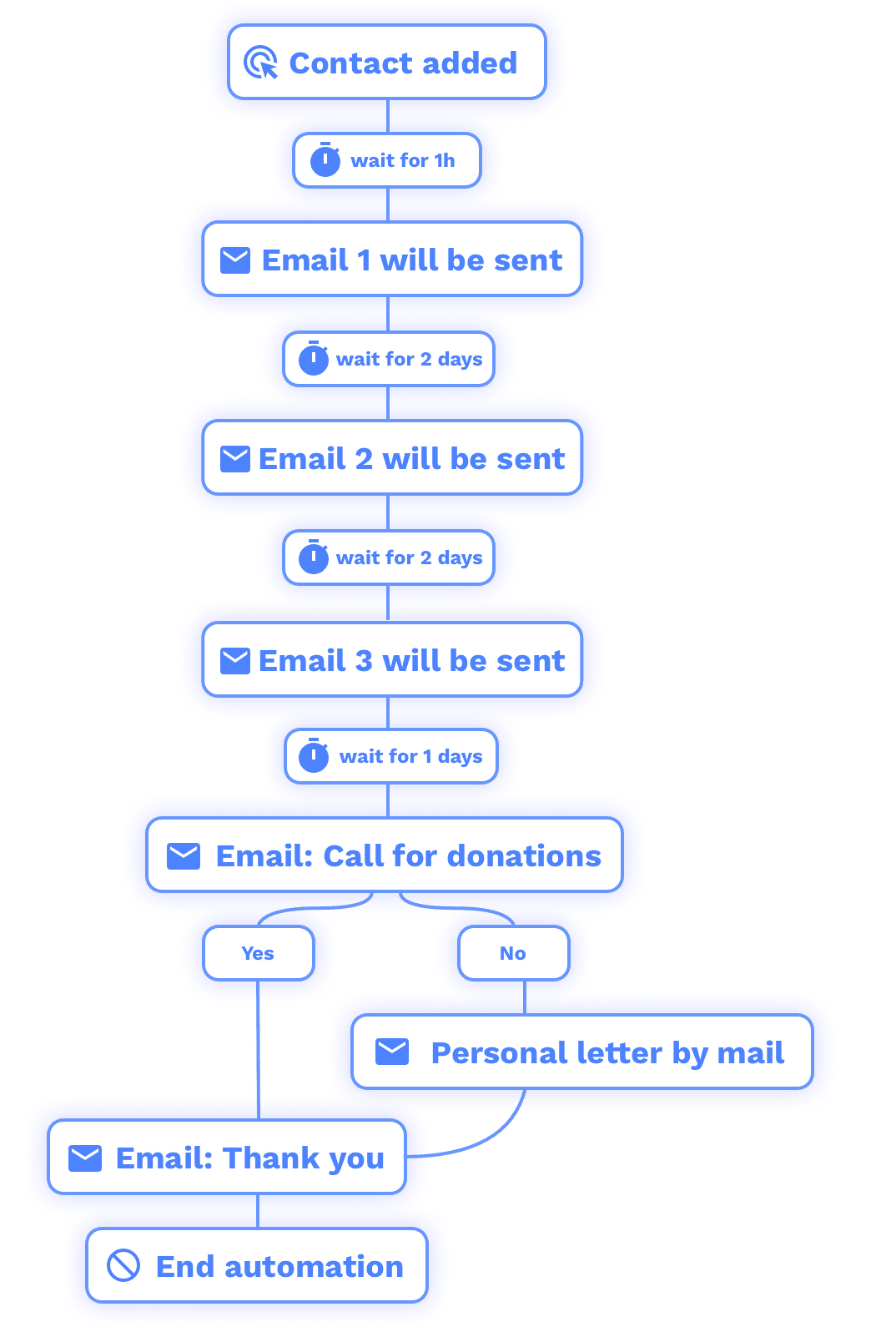

Step 3 Spark desire

If the download now leads the contact into an automated e-mail journey, knowledge about the target group can be deepened here and the contact can be presented with further attractive offers. Offer further information material in the e-mails, link to the inheritance calculator or send an invitation to an inheritance webinar including legal advice. Again, always make the value proposition clear. Conclude this email journey with an appeal to donate your estate. In addition, a mailing frequency can be set via automation. This makes everyday estate fundraising easier.

Step 4 Action please!

Digital estate communication is not so much about direct results, but rather a starting signal for relationship building. The brave will dare to complete a will online (for example, through portals like DeinAdieu) in the final step of the Journey, and will consider an organization. Others, on the other hand, will need more time and, if necessary, a personal meeting will help them. This is exactly what can be offered in the final step to relieve the last remaining doubts.

Digital estate communication is not so much about direct results, but rather a starting signal for relationship building. The brave will dare to complete a will online (for example, through portals like DeinAdieu) in the final step of the Journey, and will consider an organization. Others, on the other hand, will need more time and, if necessary, a personal meeting will help them. This is exactly what can be offered in the final step to relieve the last remaining doubts.

All in all, marketing automation helps simplify communication, save resources, reach a larger audience, and increase retention. This retention is an investment in the future of the organization.

Would you like to learn more about legacy donation? If so, we encourage you to read our Case. In it, we report on our joint project with the Swiss Red Cross Canton of Zurich, where we were able to implement such automation.

fusion_global=”3696″]